Existing today almost requires us to take technology for granted. While we go about our daily lives it advances at a breakneck pace in the background. To keep up with every new breakthrough would drive us mad; So we let it fade into noise like someone left the TV on in the other room.

But if you were to go sit in front of the screen and flip through the channel to finance you would find that something amazing is happening.

Money 2.0

Money has been the same for a very long time. We have seen some small variations but for the most part we have been physically trading paper and coins for thousands of years.

Finally in the early 2000's we saw the first drastic change for the users of money; what I have dubbed money 2.0. You could use your money to purchase anything your little heart desired using the power of the internet. It was a massive upgrade to our dated financial infrastructure, one that we desperately needed. But if 2.0 was so useable then what domains remained to be conquered in the field of currency?

Money 3.0

We've long been able to send our money almost anywhere we please so money 3.0 isn't just about usability. It's about custody, utility, and interest rates.

With Money 2.0 your bank is your custodian, they also likely utilize your savings to earn a sizable yield on the back end, and spit out a paltry 0.50% APY while they pocket the rest to appease shareholders. Unfortunately it doesn't end there, 2.0 has significant amount of other drawbacks:

- Your savings are devalued over time through inflation

- The banking industry is rife with corruption (manipulating precious metals markets, using company property to traffic drugs, money laundering & manipulating interest rates, and creating fake accounts without clients knowledge)

- If you are even perceived to have done something wrong your assets can be frozen

- Banks take a majority of money they generate for themselves, and leave you with an amount that no longer even covers inflation

- Banks operate on fractional reserve, meaning they don't need to have the money that they say they do. There is actually a 0% reserve rate right now so they aren't required to keep any money you put in. This makes them obligated to lend as much as possible to earn the highest yield for shareholders

- Banks intentionally keep legacy technology and transfer times because the longer the money is in their possession the better the yield. Here's an amazing in depth explanation by Brett King.

None of that seems very appealing, but how do we combat these issues that seem to be mostly systemic in nature? We vote with our money and withdraw it from that system. Using Stablecoins we can have custody of our money, earn higher interest rates, avoid interacting with corrupt centralized entities, and give ourselves loans at low interest rates - now that sounds like Money 3.0!

Starting Your Estate

To begin your digital estate you should first have a basic understanding of cryptocurrencies, stablecoins, and game theory. Understanding the technology and incentive systems that we will be using is important for creating a strategy that suits you, so don't skip brain day.

Once you've brushed up you're going to need a way to exit the traditional finance system. I recommend using the Gemini Exchange as it's beginner friendly and highly intuitive.

Purchasing your first currency

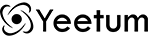

Once you've downloaded the Gemini App to your phone and plugged in your banking info it's time to make your first purchase! Navigate to the market tab on the bottom left of the app and your screen should look similar to the screenshot below.

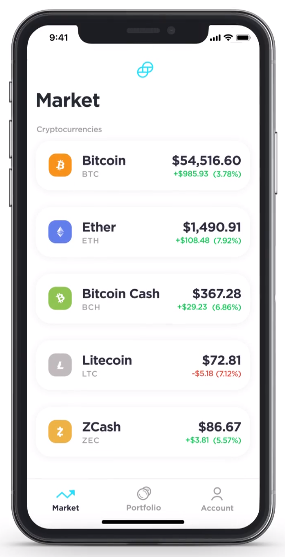

Now simply tap the currency you wish to make a purchase of and tap the buy button in the bottom left. In this example we're using Bitcoin but if you're looking to avoid volatility you need to purchase a Stablecoin such as DAI, USDC, or Tether.

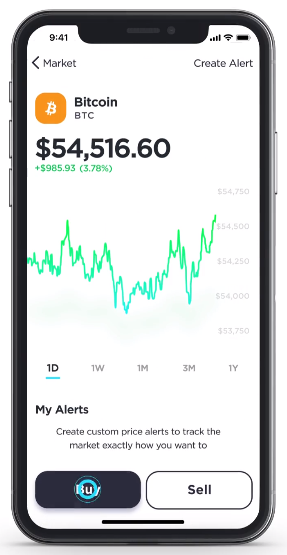

Type in the amount of USD that you'd like to exchange and then tap the 'Place Order' button at the bottom of your screen

Once you've placed your order you'll see a short animation a rocket being sent up and a capsule floating back down to earth. It should look like the screenshot below.

Once you see the 'Success!' page you'll know that your order has been placed. Congratulations you just bought your first cryptocurrency!

Taking custody of your wealth

You've now taken the first steps to building your Digital Estate, but what's next? Unfortunately your money still exists within the confines of centralized finance, so we need to wait for your balance to settle. It is relatively quick on Gemini, and once it does settle you are free to withdraw it and begin holding custody of your own money. I recommend hard wallets such as the Trezor, and social wallets such as Argent.

Expanding your Digital Estate

There are an infinite number of options for progressing from here and continuing to build your estate. If you're looking to have your family alongside you then I recommend using Zerion to track your wallets individually and as a total portfolio.

If you're looking to earn passive income on your holdings you can use tools like AAVE, Compound, or Sushiswap LP's.

Diving deeper into the Cryptoverse? Learn how to Install and use Metamask, How to avoid ETH fees using Layer2, and how to get paid interest for taking a loan using AAVEv2.

Disclaimer:

Investing requires risk taking in any market, nothing in this article should be construed as investment advice.