Since Ethereum successfully underwent The Merge Update in mid September it was expected that the currency would see significantly less inflation than previously, and that the currency would eventually be deflationary during times of heavier transaction use.

Recently however the currency began to experience something unexpected. On October 8th, 2022 the supply of Ether stopped increasing and the currency went deflationary; remaining there at the time of this articles publishing.

The Numbers:

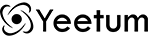

Using the data below from UltraSound.Money we can see that the net supply of Eth printed since the Merge Update peaked at 13,086 on Saturday the 8th and ended the day at 12,153 Eth. This represents a burn of over 933 Eth, valued at about $1,235,000 on the day it was burned.

Since Ether supply went deflationary over 2,700 more Eth have been burned. That means there has been a total of over $4,700,000 in Eth burned in the last 4 days alone. If the burn continues to move at its current rate then all of the Ether that has been printed since The Merge will be burned by next Tuesday, October 18th.

Using our limited sample of data we can see that Eth Supply has now started decreasing at an average rate of around 900 Ether a day. If we continued at this rate for the next year we would burn 328,500 Ether and deflate the current supply of by about 0.27%. However it is good to note that this estimate is likely overly conservative because as transaction volume increases over time Ether will begin to burn more quickly.

Comparison to Proof of Work:

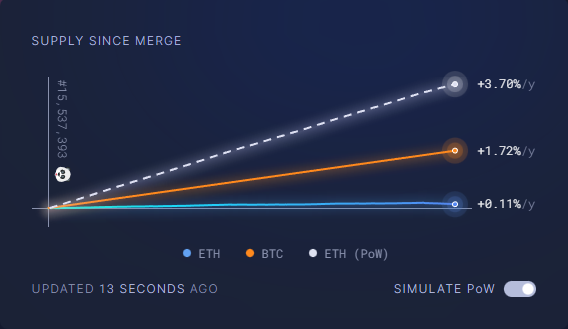

Using more data from UltraSound.Money we can see how the Ethereum network is currently performing under Proof of Stake and compare it to Ethereum or Bitcoin's Proof of Work issuance.

As you can see above Ethereum is currently running at almost 37x less inflation than it previously did under Proof of Work, and almost 17x less inflation than Bitcoin is currently experiencing. These numbers represent massive reductions in sell side pressure and will likely affect how Ether performs during the next bull market.

To put this into perspective Ethereum would have issued 311,191 Ether(Valued at $400,000,000) during this time under Proof of Work, and instead has issued 9,388 Ether(Valued at $12,200,000). This means Net Issuance has reduced by around 96.5% since The Merge occurred.

Conclusion:

It still remains to be seen whether Ether will remain deflationary indefinitely or just go through periods of deflation when transaction demand spikes. However after seeing Ether become deflationary during a bear market it seems clear that these effects on net issuance are stronger than was expected and will result in millions of Ether being burned during the next bull market.