Disclaimer: The information in this article is available via open-source channels and is not private information.

When we go through the education system, we're taught a curriculum on how business and 'real life' works. This is to prepare the young adult to embark on their professional journey to be prepared fundamentally for the challenges that come their way. Until we implement transparency in finance and corporate/business structure, we will continue failing our young leaders to build and prepare for the very real challenges that senior executives are facing.

To start we're going to take a look into the recent Hertz bankruptcy and corresponding debt structure of their organization.

The first time I saw this, I had to show a friend who's been working in finance for several years. The first thing he told me:

"I've never seen a chart like this and was never taught this in grade school or university about business and finance"

Observe the blue squares as legal entities with debt. Its interesting to note: there is two shell companies from the top entity until the organization spreads out - each level with debt. I'm not well entirely versed in these structures. I know global organizations need different entities to operate in different markets, but the key point is this is never taught or spelled out to aspiring young leaders and professionals.

To add insult to injury, as of Monday, 6-15-2020 - the Securities Exchange Commission is sanctioning Hertz to issue ~$500m new shares to public equity markets while being bankrupt. Some might call it an 'Initial Bankruptcy Offering' - didn't learn that in business school either.

To be clear, this is the United States Federal Government sanctioning securities fraud. I'll explain why... in these complex corporate capital structures, during a chapter 11 filing the finances are re-structured to preserve and transfer assets or capital. The last stakeholder entitled to money of the corporate organization is the common shareholder. The first people entitled to the money debt holders, primarily commercial banks.

Hertz owes about $20 billion in debt to its creditors. That means these recent shares the SEC has sanctioned is just a free capital raise to pay commercial banks while leaving the equity holder buying valueless stock. That is fraud, clear and crisp.

Is this what American capitalism has come to?

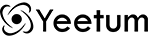

This is just one case in a global and complex economy but lets look at more holistic data released by Deutsche Bank:

This graph clearly shows the 1/5th of all corporations have debt payments that are higher than their profits. This can only happen due to financialization - this is not economic productivity. We can also observe that after the dot com bubble there is a rapid increase in this cronyism.

To be clear, this is not capitalism. This is not what Adam Smith wrote in the 'Wealth of Nations'. We have to keep in mind the Federal Reserve is promulgating the junk debt from default. The problem is that the Central Bank does not have the mechanism to restore cash flow and revenue to small-medium business or corporate's that have to service this debt. Even governments, local and state, are experiencing decreased tax revenues. They can backstop the liquidity of the big banks exposed to these debt-securities, however, but 99.99% of people don't gain that defense.

As I've shown in the case of Hertz, the equity holders of these companies are the ones that will bear the burden. That includes US Pension and 401k funds as well as the globe that is ensnared in this web.

Just cause we're on the subject of edgy finance. Here is a link to financial disclosure documents released by the US Office of Government Ethics releasing Jerome Powell, Chairman of the Federal Reserve, financial assets.

Whats obvious is how wide and deep this system goes, clearly a conflict of interest by our US Central Bank Chairman but I'll give our senior leaders the benefit of the doubt. They have an incredibly complex and hard job to fulfill with responsibility to resolve a problem with seismic magnitude for the global economy.

Whats obvious is that there are massive structural flaws that government has failed to play the role of regulator and protect the integrity of America's economic engine and well-being of American workers.

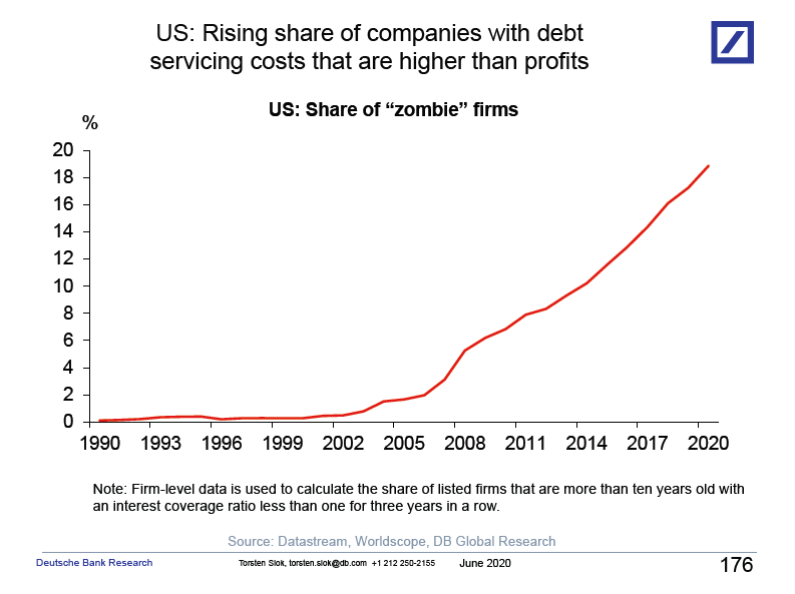

Income inequality is getting worse and to add to the social unrest and racial issues in our country, data shows all these problems are intertwined. Here's some data not only showing income inequality but the racial wealth divide:

Things are fundamentally getting worse. Institutions will not confront and educate Americans whats actually going on. We have to share information with each other to be educated on these systemic issues.

BREAKING NEWS (6-15-2020): The Federal Reserve announced a new facility to buy individual corporate bonds and broaden their corporate debt portfolio on top of the high-yield ETFs. The Federal Reserve will now be handpicking Corporate's to protect from default. As you saw above, there is massive structural flaws in corporate dynamics and their fiduciary duties - this only makes the problem bigger. This will not restore the ideals of capitalism and only incentivizes further cronyism.

This burden will fall on the taxpayer. Our grandparents, parents, cousins, brothers, sisters, and ourselves. There is a fiduciary responsibility to discuss these subjects but mainstream media will neglect to even bring up these facts and distort market narratives.

I am not anti-business or anti-America. Just a young professional concerned about our future. Be the leader willing to confront these issues. That's the work required to innovate and build the required solutions.

There is a great deal of pain in life and perhaps the only pain that can be avoided is the pain that comes from trying to avoid pain.

Godspeed.