April 9th, 2022

Q1 2022 brought a tough trading environment driven by worries of accelerated inflation, uncertainty about the effects of rate hikes by the Federal Reserve, and the horrific Russian invasion of Ukraine. The S&P500 closed the quarter down 4.6% and Bitcoin fared similarly, down 4.8% since Jan. 1st. My own portfolio closed up 18.8%. Below I will dive into some of the key trades that made this quarter, the reasoning for entry and exit, and finish with a brief outlook on Q3 2022.

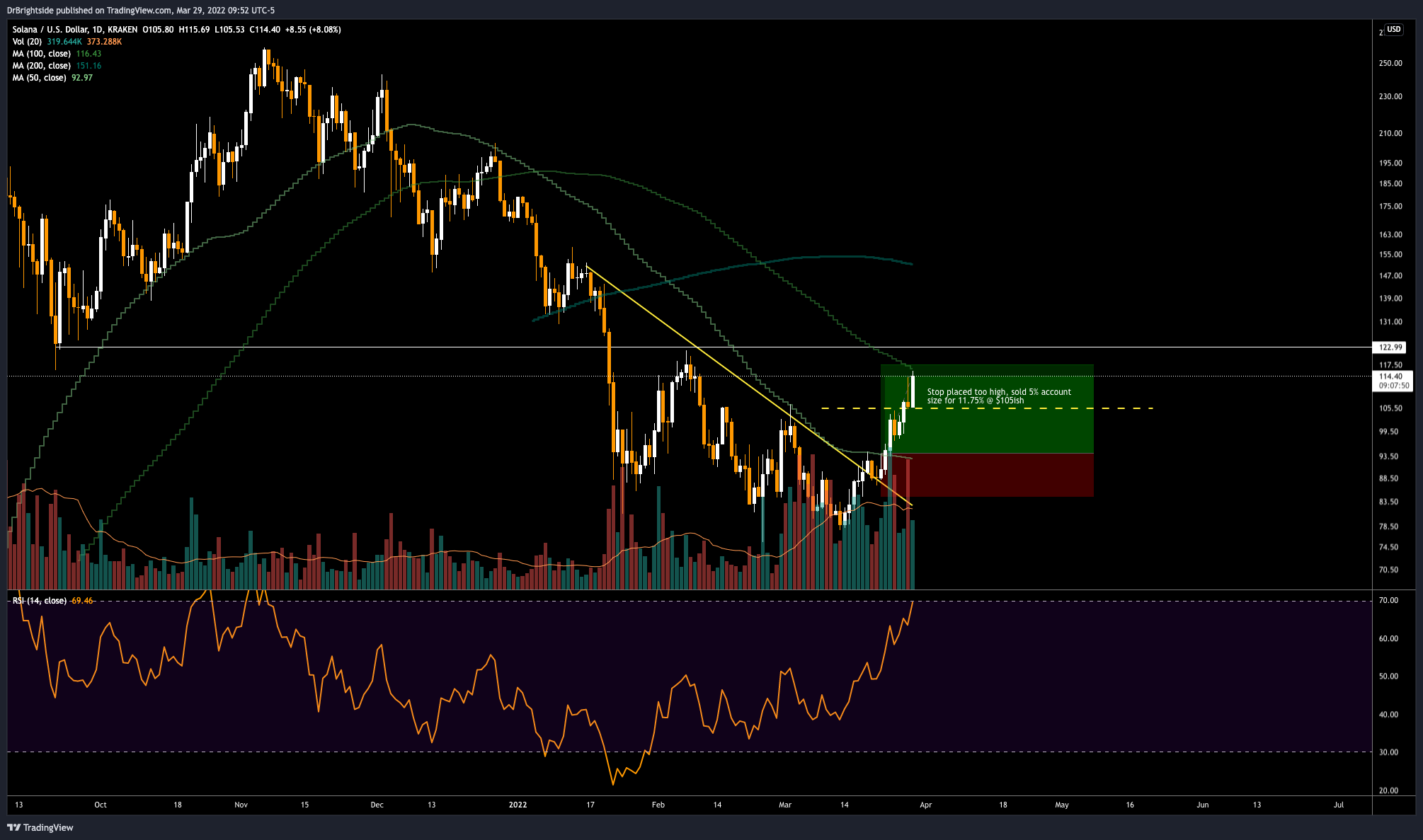

Let's start with a reminder - to myself and other fellow traders - of the importance of stop losses. This Solana ($SOL) trade on January 6th almost got me caught in a world of trouble.

I kept the stop tighter than usual on this trade because of the bearish trend shown by the inverted daily moving averages (50MA below 100MA and 200MA.)

Thankfully, my stop loss cut the position at a 3.8% loss and avoided a 50%(!) drop to the lows.

Onto the winners.

This Cosmos ($ATOM) trade below was initiated based on the downtrend breakout and retest (down-sloping yellow line) combined with the RSI breakout and retest. There wasn't a bullish RSI divergence necessarily but I liked the clean breakout and there was a lot of Twitter buzz around Cosmos at the time as well.

The stop loss was almost triggered but it was just low enough to avoid being triggered, going on to take 20 and 27% profits.

The strength of this move was phenomenal, I didn't capture the entire impulse but as you can see, ATOM went on to retest previous all-time-highs.

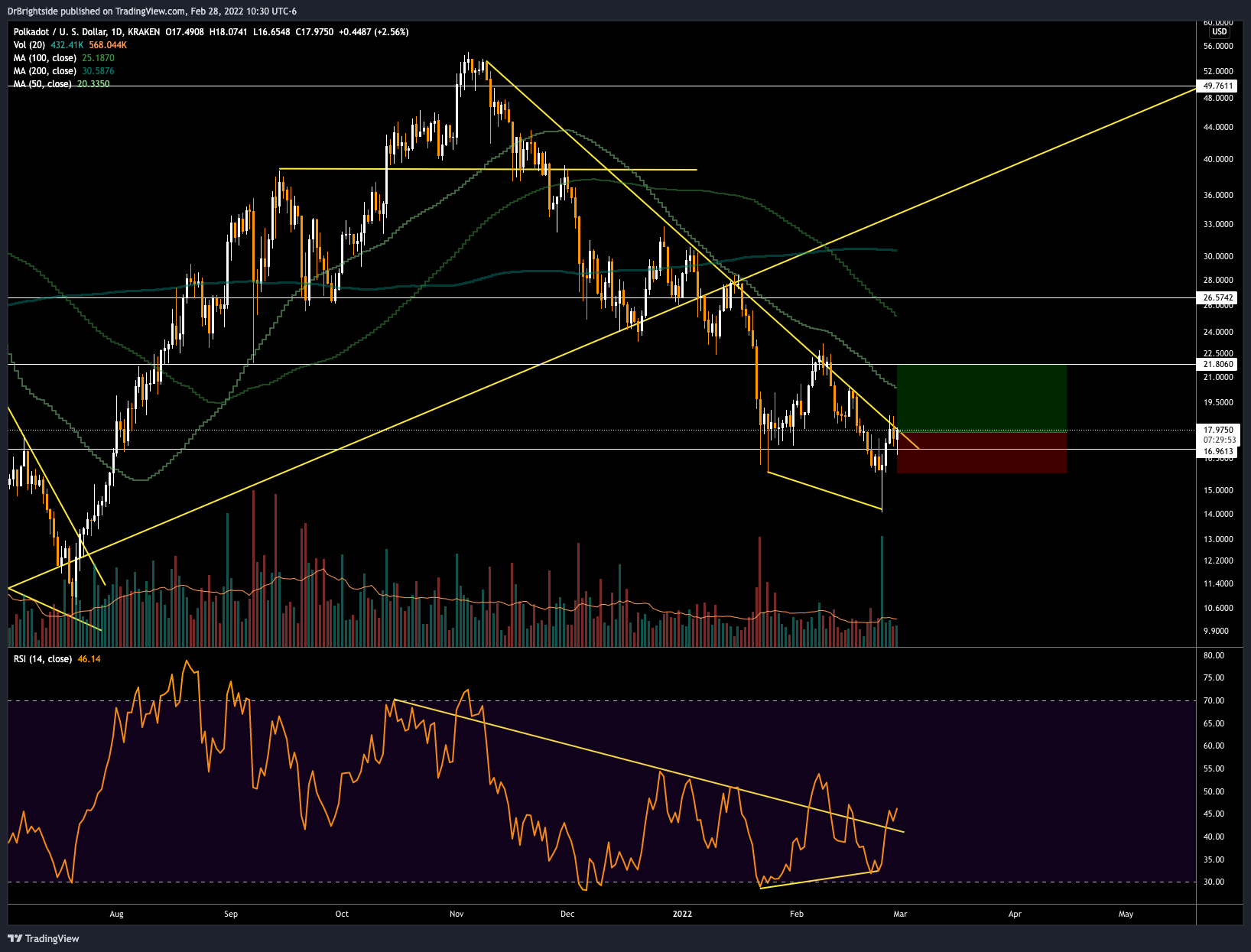

Next, Polkadot ($DOT) formed one of the cleanest bullish RSI divergences and RSI breakouts I had seen (a trend that was common around this time in the crypto space). So I setup a long with a stop-loss around $16.59 just below the lowest candle close on February 24th.

The market was incredibly pessimistic at this time, as it was the exact day when Russia invaded Ukraine. The coupling of that fearful market sentiment along with the clear bullish divergence after a >70% decline also made feel like we were close to a bottom.

Twitter reply-guys confirmed my belief people were being overly-pessimistic.

I went on to take 16% profits about a month later on March 25th.

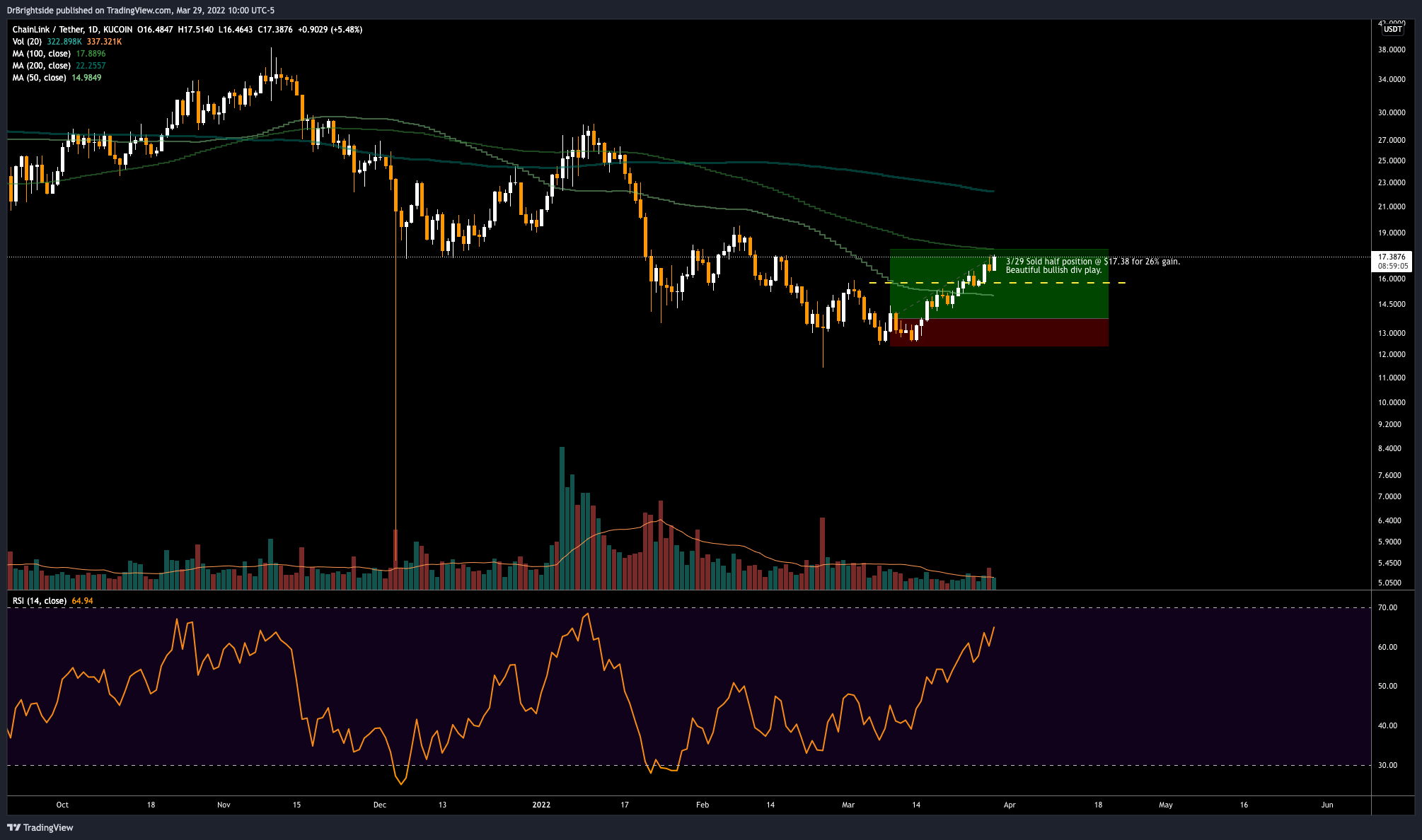

Chainlink ($LINK) made also made an RSI bullish divergence as Polkadot and Solana. Similarly, I bought where I saw the RSI turn upward with a stop-loss below the lowest recent daily close.

I set a stop loss a bit too high (yellow dotted line) and a stop-hunt wick cut half the position a ways below my original target, but I was still able to sell the second half for 26% profit.

I made a similar error on Solana ($SOL) in early March. By placing my stop loss too high, I missed my original target (which SOL went on to hit) by about 10%.

This was a small adjustment to my strategy that I will not continue to employ. I will return to market selling at my targets (when possible).

But gains are gains, the position was sold for 11.8% profit.

Q3 Outlook

With inflation taking center stage in the cultural zeitgeist and directly affecting Americans' standard of living, the Fed seems to have backed itself into a corner where it has no choice but to drastically raise rates and cut its balance sheet or risk spiraling inflation.

While the Fed has gone through periods of QT in the past, the speed at which they are forecast to hike rates this year is what seems to have markets spooked. The Fed is forecast to raise rates by half a percentage point, a move it hasn't made since the year 2000.

Bitcoin, crypto, and risk-on assets as a whole face strong headwinds as the Federal Reserve implements these inflation-taming measures. I imagine it will be harder to extract value from the markets during this quarter and will be trading more defensively, placing fewer trades overall.