Prerequisites:

- Metamask or any Web 3.0 Wallet compatible with Polygon Network

- Tokens on the Polygon Network

- Matic tokens in your Polygon Wallet to pay gas fees

- An understanding of how to use Metamask with Dapps

- An understanding of collateral, leverage, and variable interest rates

Disclaimer:

This article is written for those with basic experience using Polygon Network and interacting with Dapps, as well as those who understand the risks of leverage even when using non-volatile assets like Stablecoins. Please understand that all rates are variable and subject to volatility, managing these positions is only for someone who understands the risks and actively manages their holdings.

Connecting your wallet

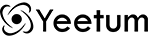

To begin our journey towards getting paid for a loan we first need to take a look at the market tab of the AAVE V2 app. Make sure to select the purple button representing Polygons AAVE market at the very top, then you can connect your wallet. Once you have your wallet connected select the markets tab along the left of the top menu and your screen should look similar to the screenshot below. If you need help setting up your Metamask wallet you can refer to this guide.

Reviewing your options

Now that we've gotten the housekeeping out of the way lets look at the market and select which token we should deposit to use as collateral. To keep things simple in this example we will stick to Stablecoins only. That means we have USDC, USDT, and DAI to work with. Unfortunately USDT is not allowed as collateral so that is ruled out. Looking at the two remaining options we can check the deposit APY column and see that DAI will earn us an interest rate of 6.86%+2.52% Matic, and USDC will earn us an interest rate of 16.32%+2.01% Matic. Since we are looking to maximize our earned interest USDC makes for the best option.

Depositing collateral

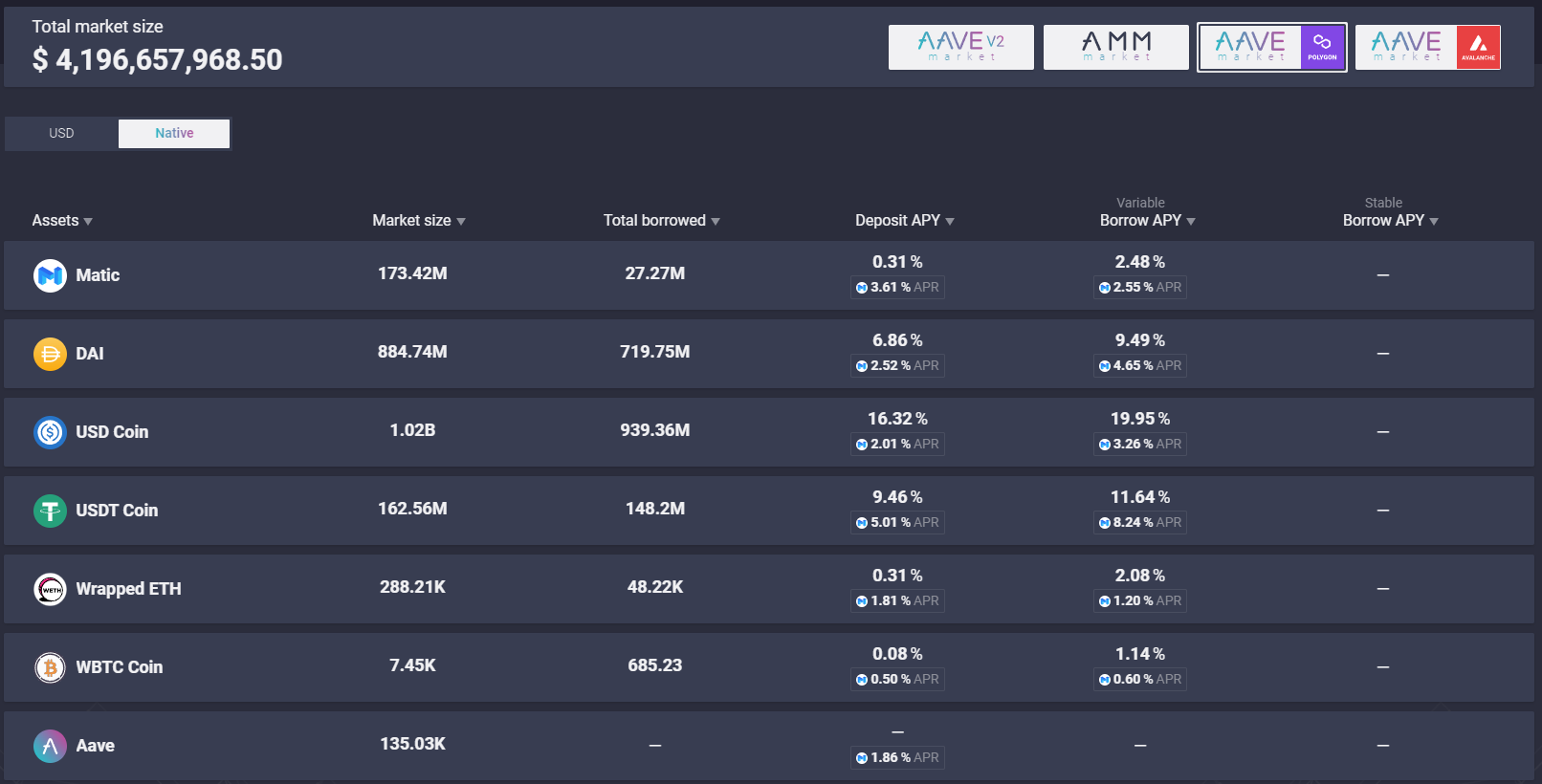

Below you can see I've already got USDC in my wallet. If you need to use Sushiswap to exchange your tokens and are unsure of how then you can follow my guide here. Once you have your USDC ready to go then you click on your balance and select deposit. Follow the pop-ups for Metamask asking you to confirm the transaction, then once it's confirmed you've deposited your collateral successfully.

Selecting a Stablecoin to Borrow

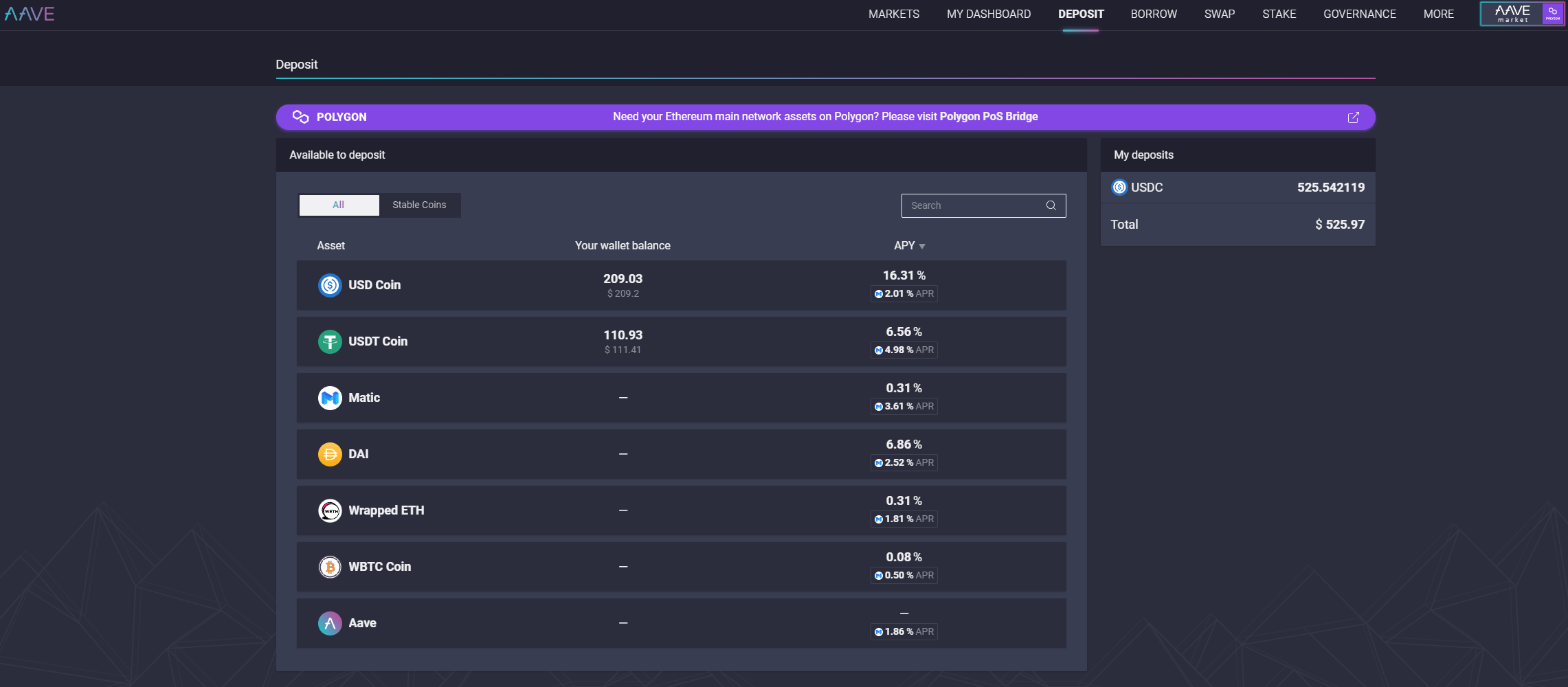

Now that our collateral is deposited and earning us interest it's time to take a look at the borrow tab. As you can see from the screenshot below we are limited to our three Stablecoin options again, DAI, USDC, and USDT. This time however we need to select the lowest interest rate because that is what we'll be paying to take out our loan. It is important to remember that you also get paid interest in Matic for taking out the loan.

Looking below we can see that to borrow DAI we will pay 9.48%-4.65% Matic, for USDC we will pay 19.97%-3.26% Matic, and for USDT we will pay 12.13%-8.19% Matic. Since USDT has the lowest rates for borrowing, we should select that and choose borrow. A menu asking how much you'd like to borrow will pop up, be sure not to borrow too much, the closer to 1.00 your health factor is the more risk of liquidation you face. After that the same Metamask confirmation prompts will pop-up, simply click confirm and wait for the transaction to complete. Once it does congratulations you've taken your first decentralized loan!

The Home Stretch: Getting paid for your loan

At this point you may be thinking that getting a loan at a 4% interest rate is great and all but you said we would be getting paid to take a loan, where does that money come from? Well the USDT that you borrowed is now yours to do with as you please. As we can see from taking another look at the markets tab below: depositing it would provide another 9.46% interest + 5.01% Matic. However you can also swap your USDT for whatever you'd like now that you've borrowed it, nothing is stopping you from swapping to USDC on SushiSwap and claiming that sweet 16.32%+2.01% Matic.

As long as the Matic earned per year from the loan plus the interest and Matic earned from depositing what you've borrowed is greater than the interest you're paying per year you're getting paid to take a loan! In our example we would make 10-14% APY at current rates by depositing what we borrowed into AAVEv2 as USDT or USDC and pocketing the difference.

Closing Advice

Keep an eye on your open positions by viewing the dashboard. Be sure to keep your Health Factor well above 1.00 to avoid liquidation and check your interest rates daily so you know the variable rates haven't changed enough to make the loan no longer worth it.

Once you've taken the loan there are no limits to what you can do with it. You're free to withdraw it to other apps if you find a better yield, withdraw it to cash, or loan it to exchanges like Sushi-Swap to earn fees. As long as you outpace the interest paid you will be making money with money that isn't yours, and that's one of the keys to building wealth.