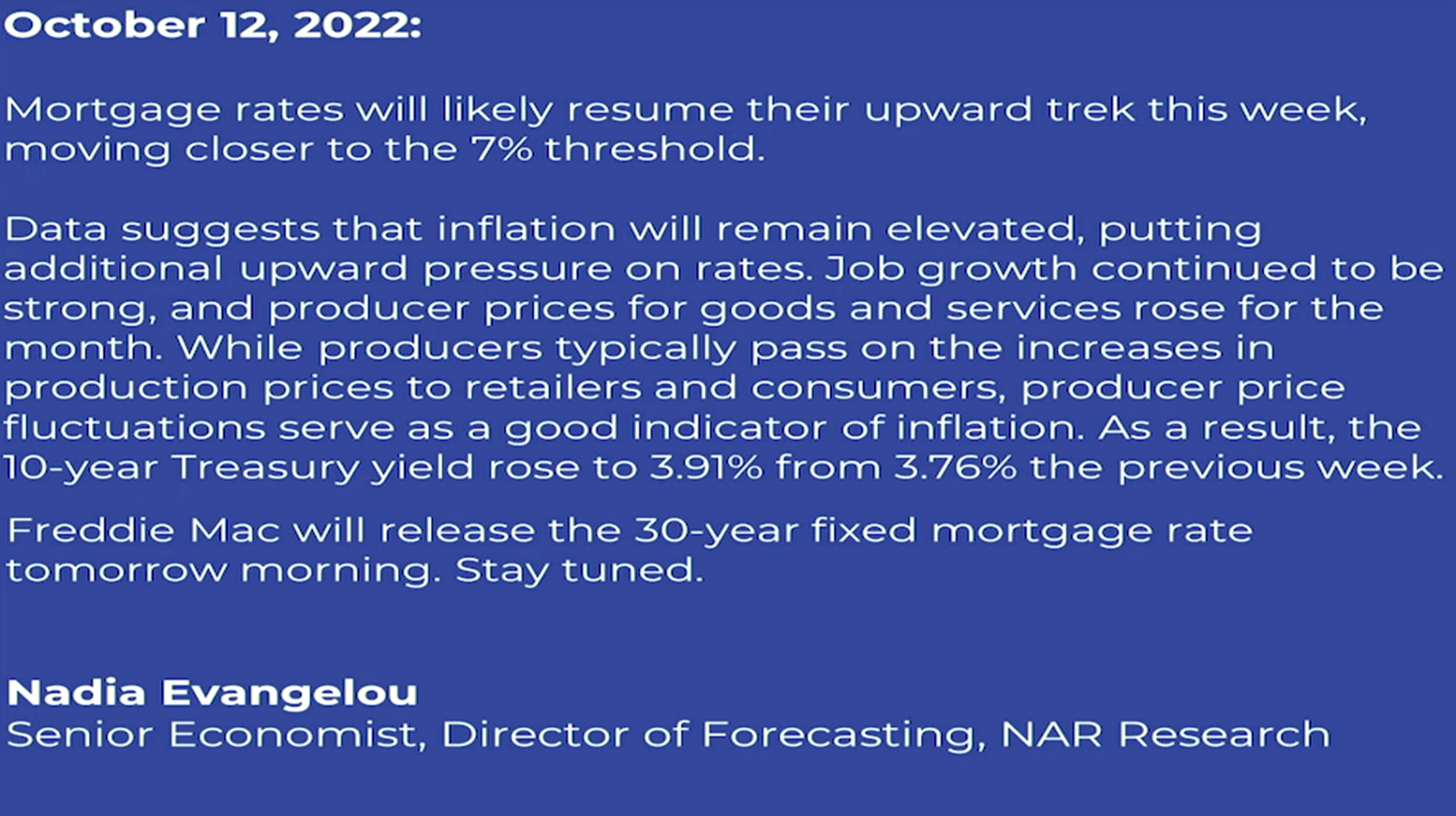

The National Association of Realtors issued a warning regarding the housing market earlier this week. The warning states that mortgage rates will likely continue trending upwards and can be read in it's entirety below.

If we see mortgage rates continuing to climb it will have a multitude of effects. It's probable that as a result interest rates will increase, housing demand will cool off, and housing prices will decrease as demand falters.

In an article the following day Nadia Evangelou gave confirmation that mortgage rates rose as expected, coming in at a whopping 6.91%. Those who struggled with finding a home to purchase earlier this year are now looking at an overabundance of supply that mortgage rates have made unaffordable. As a good rule of thumb every 1% increase in mortgage rates results in a 10% decrease in buying power, making housing over 30% more expensive for buyers during the past year alone. She goes on to say that rent has continued to increase as well, heavily affecting the 50% of renters who are already cost burdened.

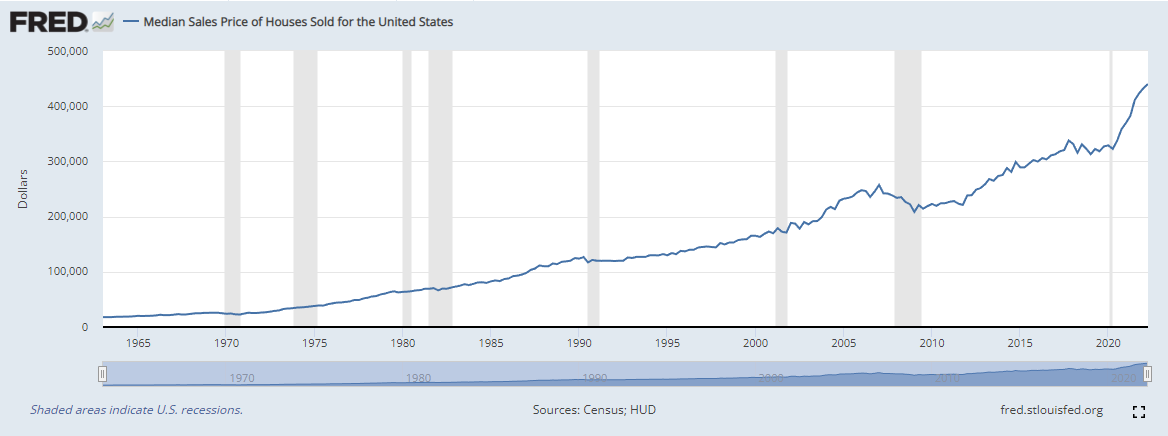

Looking at the data for median housing price in the United States it's very likely that we are seeing a significant housing bubble that has many contributing factors. Below are some of the elements which played a part in increasing housing prices during this time.

- Corporate investors bought 25% of U.S. single family homes during 2021

- Home rental companies continued to reduce the available supply of purchasable housing

- Housing Investors focused on growing cities, buying the best deals on the cheapest properties in expanding areas then neglecting to make repairs and continually squeezing tenants for further cash

All of these actions resulted in an exaggerated version of the effects of previous housing shortages, where supply was artificially limited by those with the capital to afford vacuuming up housing liquidity on the open market.

The situation seems eerily similar to the 2008 Housing Crash(minus the sub-prime mortgages) in which inflation was rising heavily, mortgage rates were increased significantly, and consumers were seriously cutting back on discretionary spending.

The negative feedback loop from these effects threw the U.S. Economy into a recession for multiple years and may offer a look at what's in store for us in the near future.

Conclusion:

With the scale of the current housing bubble it's almost certain a housing crash or long term correction will occur, it's just a matter of when. Seeing mortgage rates rising, interest rates increasing, consumer confidence reaching record lows, housing supply increasing, house prices falling, and housing demand falling are all indicators that we may see a correction sooner rather than later.