This article is an analysis and speculation into a new monetary regime.

Recently, the Bank of International Settlements (BIS) has released a report, in collaboration with G7 central banks, regarding their intentions of launching new central bank digital currencies (CBDC). While these projects have been cooking for a while these reports are published with intentions to adopt a new neo-monetary system within the decade. The BIS is often known as the ‘central bank of central banks’.

The BIS (Bank for International Settlements), was established in 1930 and is owned by 63 central banks that represent countries who — in sum — account for 95% of the world’s GDP. The BIS acts as a prime counter-party for central banks in their financial transactions and serves as a trustee in connection with international financial banking operations. The BIS also regularly publishes analyses on international banking and financial statistics that underpin policy making.

Now, we can speculate from here on the infinite scenarios and probabilities but lets recap quickly on some mostly unknown monetary history that is often ignored throughout our political processes and institutional education system.

Central Banking is a foundational pillar to the establishment and epicenter to which our centers of powers converge. Safeguarding public trust in money, maintaining price stability, and ensuring resilient payments infrastructure are among the core means through which central banks support public welfare.

As the original Central Banker, Mayer Amschel Rothschild, said: “Give me control of a nation’s money and I care not who makes it’s laws.” Mayer Rothschild sent his sons to open and control all the major banks in Europe, creating a banking empire to which every king and queen was beholden and leading to a powerful dynasty that still greatly influences nearly every public policy in today’s world.

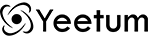

The central banks are cartels that monopolize the most important asset a country has — its monetary system. Most wars aren’t fought over the squabbles used as the excuses. Most are fought over monetary systems. In the U.S., Congress is the only entity who constitutionally has the right “to coin money” (through the Treasury) and regulate money. Since the inception of the Fed in 1913, the dollar has lost 97% of its value (inflation), most of which has occurred since the decoupling with gold/silver in 1973 and replaced by the petro-dollar (international agreement to trade all oil in Federal Reserve Notes).

Since 1973, our monetary system has been what’s known as a “fiat currency”, backed by nothing more than people’s belief it’s worth something. The worth of these notes losing value and the manipulation of that value by the central banks creates what’s known as “malinvestment”, investment into the less productive. Instead of saving money and eventually investing in themselves and/or their own opportunities, people are forced to invest in riskier ventures just to try to break even. Credit, aka Debt, becomes the instrument of transactions from the government level all the way down to the personal level.

The system the central banks utilize is a “planned obsolescence” system and it is nearing its end. When I use the phrase “planned obsolescence”, I mean that it’s an unsustainable and ever-increasing debt load… by design. From the very first dollar borrowed from The Federal Reserve — which is neither federal, nor has reserves — the spiral began. The only way to pay the debt on that first dollar is to borrow more to pay the interest on that dollar. The debt load multiplies exponentially until it’s unsustainable. Eventually the death spiral collapses… which is what I think we’re nearing. Remember we’re over a 100 years into this experiment.

The central banks were ready to use a major war or the virus to cripple the system, sending us into a depression, then replace it with their own new system to start the cycle again — part of what’s known as “The Great Reset” (which also involved China becoming the preeminent world power), as called by the World Economic Forum. Their digital currency is part of that plan. The plan is premature and contested by shadow circles, but they have no alternative than to continue down that path.

The central banks will open direct bank accounts to the citizens on their sovereignty. They will be able to leverage big data to have dynamic interests rates. Want to support younger people saving? Higher interest rates on those accounts. Want to stop retirement folks from hoarding the cash? Give them negative interest rates. Its truly groundbreaking for the transmission of monetary policy. We’re only scratching the surface for this new regime.

The control they’ll gain under a digital currency would be multiple times more than their current monopoly. Don’t take a vaccine? We’ll cut off access to your “credits”. Don’t wear a mask? Account cancelled. Support the wrong cause, “Sorry, your money is currently unavailable.” It’s truly a scary proposition of what’s to come.

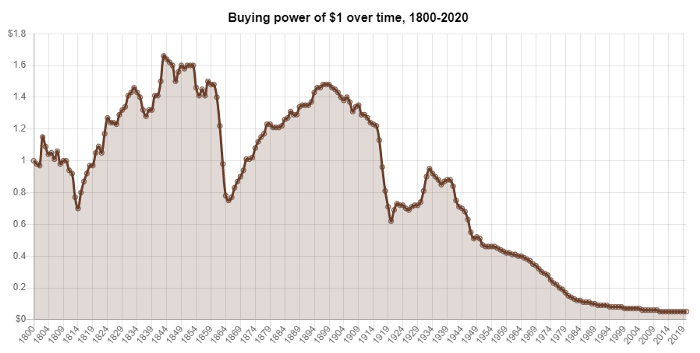

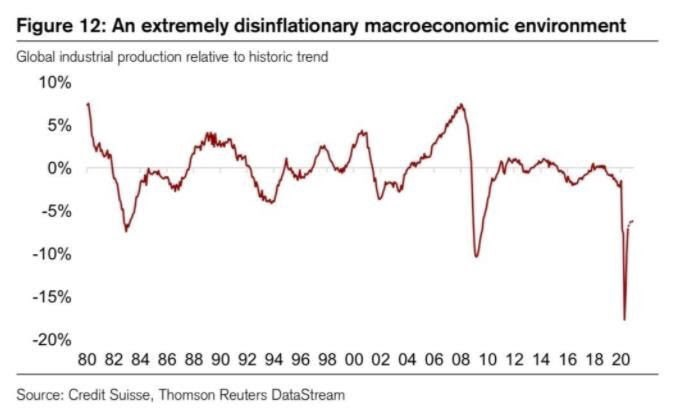

The corona-virus has accelerated the current design of this debt-fueled system which is what is causing our K-shaped recovery.

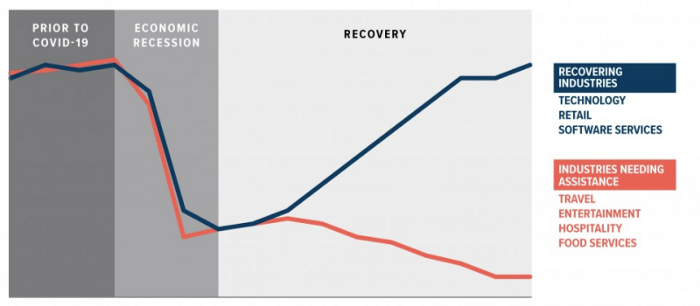

The top half of the “K” are those who are benefiting from financial markets’ continuing inflation due to the Fed’s participation in buying High-Yield Exchange Traded Funds (ETFs) — something unprecedented. There’s also irrational exuberance since COVID ended the country’s longest ever economic expansion — an event some believe to be the “shortest recession and speediest recovery ever.”

Governments have borrowed some $11 trillion in the first five months of 2020, and is up some 70% over the last five years.

More broadly, the Institute of International Finance found in an April paper that total global debt rose to $255 trillion by the end of 2019. Equivalent to 322% of worldwide output.

In the near-term, it appears the European Central Bank is ready to go further negative and I only imagine the Federal Reserve would follow suit. Thus further destroying bond yields. Consequentially, destroying risk-free assets leads pension funds and asset managers across the globe chasing for yield.

A second funny money stimulus is on the horizon and the next US president will more than likely launch a massive ‘infrastructure’ or ‘green new deal’ fiscal stimulus. . . the name will be dependent on which party wins.

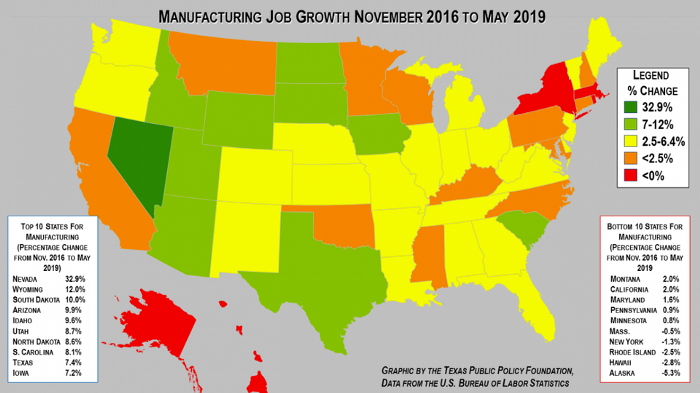

Hold your political bias for a moment and remain objective with me. The current administration has been building a parallel economy that can survive the crash (think manufacturing repatriation). The national emergency generated by the corona-virus allowed the administration to bring the Federal Reserve into the U.S. Treasury.

Nearly all the spending you’ve seen over the past few months and will see on the horizon (infrastructure in particular) are on the books of the Federal reserve, not the U.S. government and The People.

The means to this is Special Purpose Vehicles, SPV’s, through Blackstone with over $8 trillion in assets under management. Most of the public debt is also now on the Fed’s books (e.g. state & municipal debt/bonds, etc). Additionally, they’re also directly purchasing corporate bonds through these same means.

No debt monetization left untouched.

For the first time, the Fed now has a vested interest in the U.S.’ success or failure instead of just being its “bookie” and debt monetizer.

Right now, the obvious plan is continued currency debasement and attempt to inflate out of our debt woes, as previous business cycles.

Now enough boring central banking…

How do we position ourselves? How do we prepare for the future? What will happen to markets?

While the digital asset space is continuing to grow its important to know major trends and developments that have occurred in 2020.

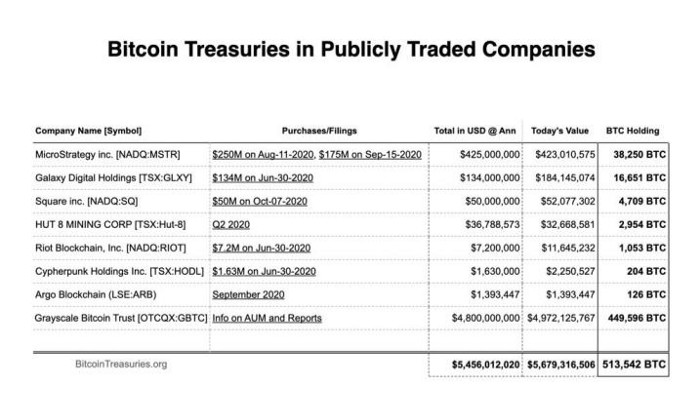

Banks have been recently granted custodian ability to account for digital assets and crypto-currencies. We’re seeing increased adoption of Bitcoin as an asset on the balance sheet in large corporations and institutions.

Additionally, the macro data continues to point to deflationary pressure. While financial media, might create the narrative of a strong recovery the bottom line is we suffered a whopping -32.9% hit to GDP in Q2. Cash flow and balance sheets are permanently damaged. Fiscal stimulus does not restore this cash flow and revenue problem.

It is now becoming obvious there’s very few mechanisms to escape the risks we’re exposed to. The trends above will continue and investors at all levels will position how they see fit. We strongly recommended researching the value of digital assets and crypto-currencies in this monetary environment. Feel free to reach out to collaborate.

Our economic pains will continue. We speculate people of means will transition their capital into digital assets in the coming years. People of small means can leverage these insights to prepare their families.

At a retail level its not too late to exercise discipline in your budgeting, saving, investing, spending and position accordingly for the long-haul. Institutions are beginning to allocate capital to the digital asset space.

While these are incredibly complex subjects and systems, we can democratize our knowledge by having discussions with our peers and family on these tough subjects. When has any political debate revolved around monetary policy and the future of our distribution and allocation of capital?

As we continue this chaotic year of 2020 we must find some rationality in the irrationality. Share your insights, be curious, and always continue to learn.

Godspeed.